In our previous article, we emphasised the importance of separating personal and business finances to ensure audit compliance, professionalism, and credibility. Thus, the question of using a personal bank account for business use in Singapore should be a straightforward NO. Singapore’s strategic location in Southeast Asia serves as a gateway to rapidly growing markets. This makes it important for businesses to establish a solid financial foundation. Therefore, it would be highly beneficial to set up a Singapore business bank account dedicated solely to business transactions and purposes.

In this guide, we help you learn how to choose the right business bank account for your needs and the kind of account you should utilise for your business. Read on to find out more!

Key Considerations for Your Business Bank Account in Singapore

Choosing the right business bank account is vital. The following factors should be considered before deciding on the best business banking account for your needs:

Compliance in Business Banking

When opening a business bank account in Singapore, it is important to consider features that can help your business stay compliant with regulations. Compliance ensures adherence to regulations and legal requirements, safeguarding your business from potential issues. Knowing your bank adheres to strict compliance standards ensures peace of mind.Some examples of compliance features in business bank accounts include:

- Know Your Customer (KYC) checks

- Anti-Money Laundering (AML) monitoring

- Sanctions screening

Audit and Bookkeeping

Efficient auditing and bookkeeping are essential for maintaining the financial health of your business. Opt for business bank accounts that facilitate seamless auditing processes, such as the OCBC business banking account, which offers features like unlimited free FAST and GIRO transactions, easing the burden of financial management.

Multi Currency Business Banking

In an increasingly globalised business landscape, the benefits of using a multi currency business bank account can be highly substantial. Business bank accounts such as the DBS Business Multi Currency Account offer the flexibility to receive and transact in multiple currencies, simplifying cross-border transactions and catering to businesses with international operations. For digital nomads in Singapore, a multi-currency business bank account is a valuable tool for managing their international finances seamlessly.

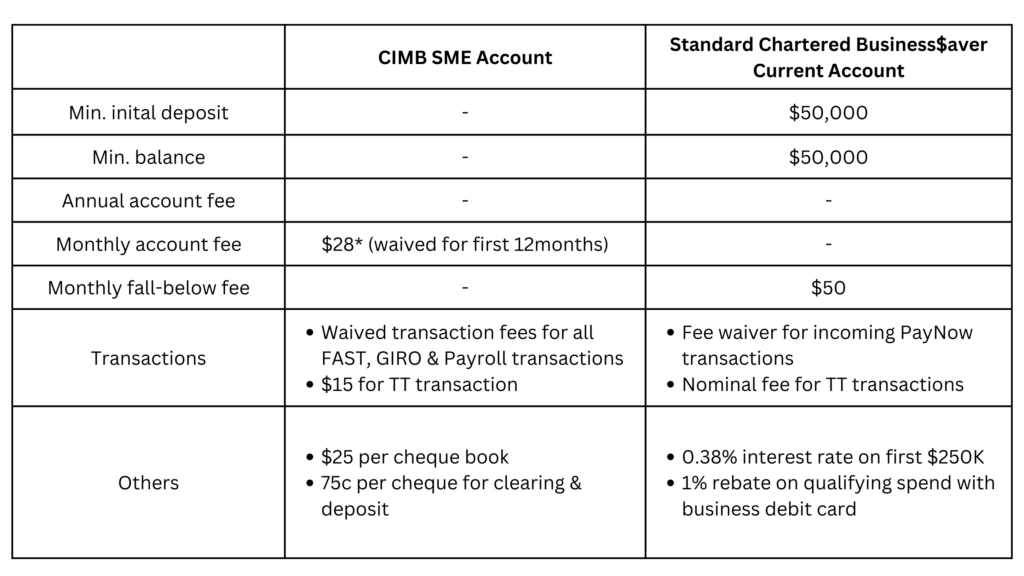

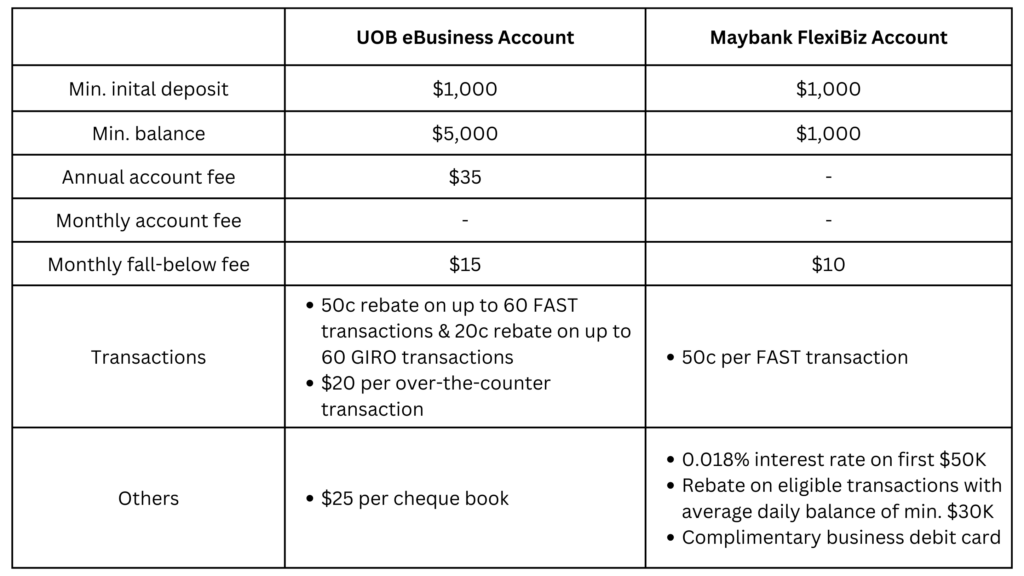

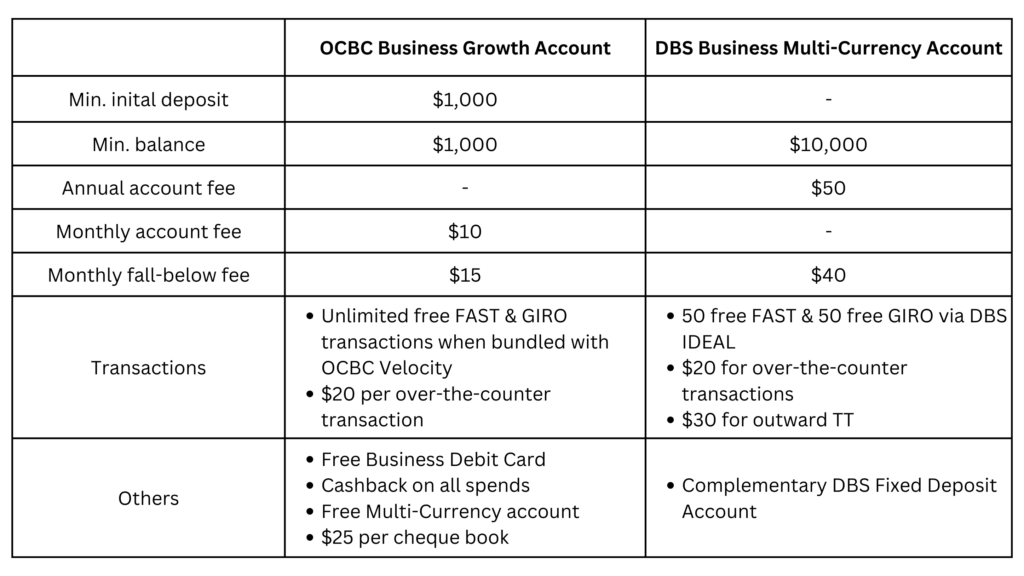

Business Bank Account Fees

When deciding on the best business banking accounts, carefully assess fees such as fall below fees, monthly account fees, transaction options and fees, and chequebook charges. Individually, these fees may seem nominal but as they accumulate, they become unnecessary expenses that can eat into the profits of your business. Some business bank accounts for small businesses may also require a minimum initial deposit. This might be difficult for small businesses with lower capital and might affect the funds needed for business operations.

By comparing different business bank accounts and their fee structures, you can find an option that aligns with your business’s transaction volume and avoid unnecessary charges. This helps you to manage your finances effectively and focus on growing your business.

Business Bank Account in Singapore

1. DBS Business Multi Currency Account

Businesses within 3 years of their incorporation date can enjoy zero initial deposit or minimum balances under the Starter Bundle of a DBS Multi currency account. Some of the other features provided by this DBS business account include:

- Ability to transact in SGD and 12 other currencies, including AUD, CAD, CHF, CNH, EUR, GBP, HKD, JPY, NOK, NZD, SEK, and USD.

- Unlimited free FAST and GIRO transactions.

- $10 monthly account fee with no fall below fee.

- $25 per chequebook and $3 per cheque issued thereafter.

- $30 flat fee for outward TT.

In addition to considering the DBS multi currency account, business owners looking at signing up for a DBS corporate account can check out the DBS SME banking website for more tips and information on the products and services provided.

2. OCBC Business Growth Account

As the name suggests, the OCBC Business Growth Account is a great option for small businesses and startups looking to scale their business. While it may not have the multi currency feature unlike the DBS multi currency account, this OCBC business banking account allows business owners to get up to 1% cashback on business spending with a business bank account by using the free OCBC Business Debit Card. This business bank account also has these other features:

- Unlimited free FAST, GIRO, and payroll transactions

- $10 monthly account fee, first 2 months waived

- Initial deposit of $1,000 and fall below fee of $15

- $25 per chequebook and $0.75 per cheque issued thereafter

- Up to 1% cashback on free OCBC Business Debit Card

- No minimum spend or annual fees on Debit Card

- Early closure fee: $50 for accounts closed within first 12 months

3. UOB eBusiness Account

The UOB eBusiness Account is designed for business owners who prefer managing their business banking transactions, such as checking account balances, transferring funds, and making payments, online. Similar to the OCBC business banking account above, this UOB business banking account does not have the multi currency feature of the DBS multi currency account but does provide the following features instead:

- $0.20 fee per GIRO transaction with rebate for up to 60 GIRO payments per month

- $0.50 fee per FAST transaction with rebate for up to 60 FAST payments per month

- $35 yearly account fee

- Initial deposit of $1,000 and fall below fee of $15 if average balance less than $5,000 (free waiver for 12 months for new accounts)

- 30 free cheques and $0.75 per cheque issued thereafter

- Early closure fee: $30 for accounts closed within first 6 months

4. Maybank Flexibiz Account

The Maybank FlexiBiz Account is mainly targeted at businesses looking for flexible business banking solutions.

- Unlimited free FAST and GIRO transactions

- $0 monthly account fee

- Initial deposit of $1,000 and fall below fee of $10 if average balance less than $1,000

- $0.75 per cheque issued

- Early closure fee: $50 for accounts closed within first 6 months

5. CIMB SME Account

CIMB Bank is well-established in the ASEAN region and provides access to services in multiple countries, making it a convenient option for businesses with cross-border activities similar to the accessibility of the DBS multi currency account. Their CIMB SME Account is tailored to the needs of small and medium-sized businesses:

- Unlimited free FAST, GIRO and payroll transactions via BizChannel@CIMB

- $28 monthly account fee for digital account (free waiver for 12 months for new accounts)

- Initial deposit of $5,000 and no fall below fee

- $25 per chequebook and cheque clearing fee is waived

- Early closure fee: $40 for accounts closed within first 6 months

6. Standard Chartered Business$aver Account

Standard Chartered Business$aver account is a business current account that can earn up to 2.00% p.a. interest. This can be a great way to earn interest on your business’s idle cash. Additionally, existing Standard Chartered clients may be eligible for bonus interest rates.

- 0.38% interest rate p.a. on first $250,000

- Fee waiver on incoming PayNow transactions

- Initial deposit of $50,000 and fall below fee of $50 if monthly average balance less than $50,000

- Nominal fee for TT transactions

- 1% rebate on qualifying spends on the Business Debit card

- Early closure fee: $500 for accounts closed within the first 6 months

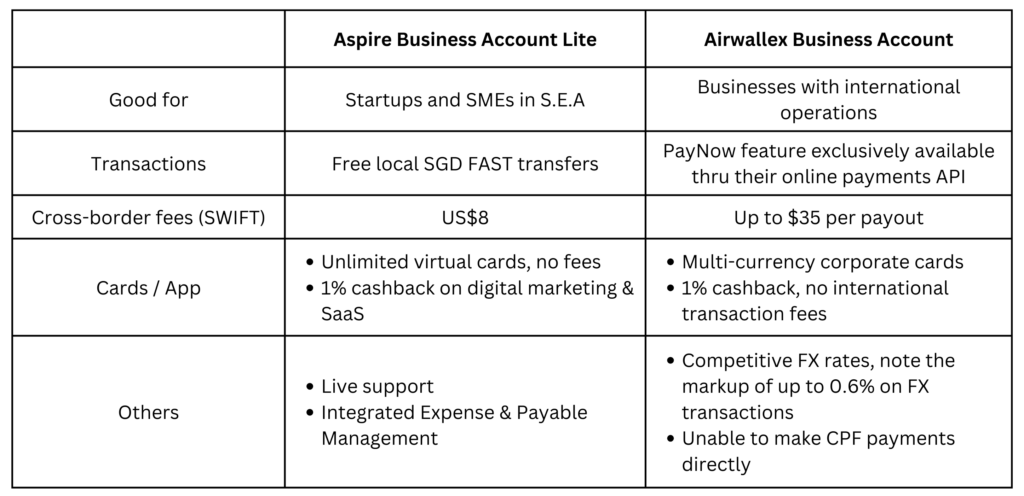

Here’s a quick summary for your easy comparison

Digital Business Bank Account

Beyond traditional banks, digital business bank accounts are emerging as a popular option for startups and SMEs in Singapore. These accounts are usually offered by fintech companies and come with competitive fee structures, user-friendly online interfaces and a quicker account opening process.

1. Aspire

Primarily focused on serving SMEs and startups in Southeast Asia, Aspire‘s business account lite offers:

- Multi currency accounts in SGD, IDR, USD with EUR & HKD

- No minimum balance

- Free local transfers

- Unlimited 1% cashback on card spend for digital marketing & subscriptions

Ideal for: Startups and small businesses looking for a fuss-free and cost-effective way to manage their finances.

2. Airwallex

Airwallex offers a comprehensive digital business bank account solution. They focus on flexibility and international transactions.

- Competitive foreign exchange rates

- Global payment solution, from accepting payment to vendor invoices

- Streamline your workflow with a seamless integration of your accounting solutions

Ideal for: Growing businesses or businesses with international operations

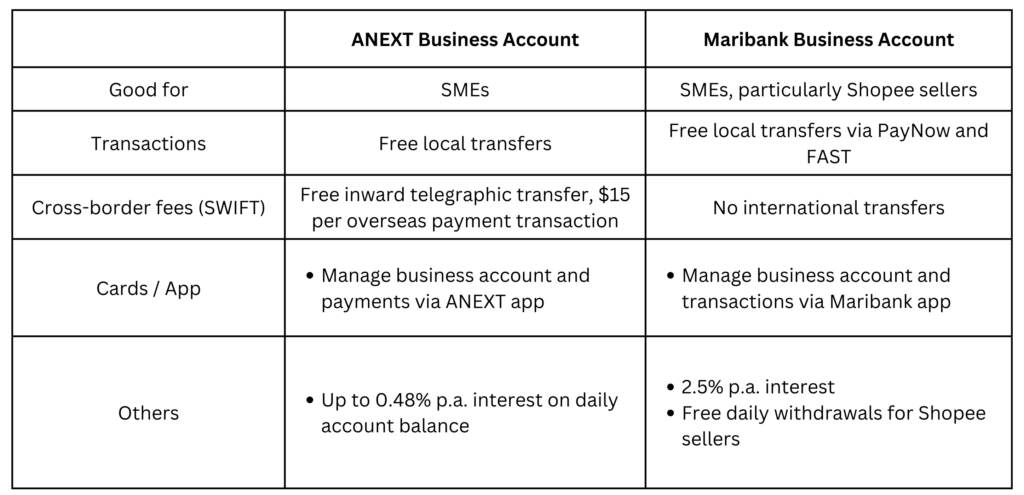

3. ANEXT Bank

Backed by the Alibaba Group, ANEXT provides digital banking solutions specifically designed for SMEs in Singapore. They prioritize growth and financial management:

- No upfront and hidden fees

- Unlimited local transfers

- Unlimited inward telegraphic transfers

- Competitive flat fees for overseas payments

Ideal for: SMEs seeking a digital banking partner with industry expertise and dedicated SME support.

4. Maribank

Maribank, launched by SEA Limited, offers a digital business bank account that integrates seamlessly with your e-commerce operations:

- Seamless Shopee integration

- Efficient daily payouts from your Shopee store with no fees

- $0 banking fees and 2.5% p.a. interest

Ideal for: Online businesses, especially sellers on Shopee platform, seaking a convenient and integrated way to manage their finances.

A quick overview of digital business bank accounts

Which Business Bank Account To Go With?

In today’s digital landscape, both traditional and digital banks offer unique advantages for SMEs in Singapore. Traditional banks provide established trust and a wider network of physical branches, while digital banks often come with streamlined processes, lower fees and innovative features.

Ultimately, the best choice depends on your specific business needs and priorities.

Considering A Business Loan?

No matter which business bank account you choose, funding your business goals may require additional support. We understand the challenges faced by SMEs in securing loans or working capital loans. Hence, we make it easy for your small business to access funds quickly - enabling you to take your business to the next step.