Guide to Setting Up e-Giro for Loan Repayment

You’ve taken the first step to achieving your business goals with Poss Capital. The next step is to set up eGIRO to streamline your repayment process and ensure timely payments.

eGIRO is a convenient and secure way to authorise automatic deductions from your bank business account directly towards your business loan repayment.

This guide will walk you through the simple steps of applying for eGIRO so you can enjoy a hassle-free repayment experience.

Please note that eGIRO setup is currently available for OCBC, DBS, UOB and MAYBANK bank account holders only.

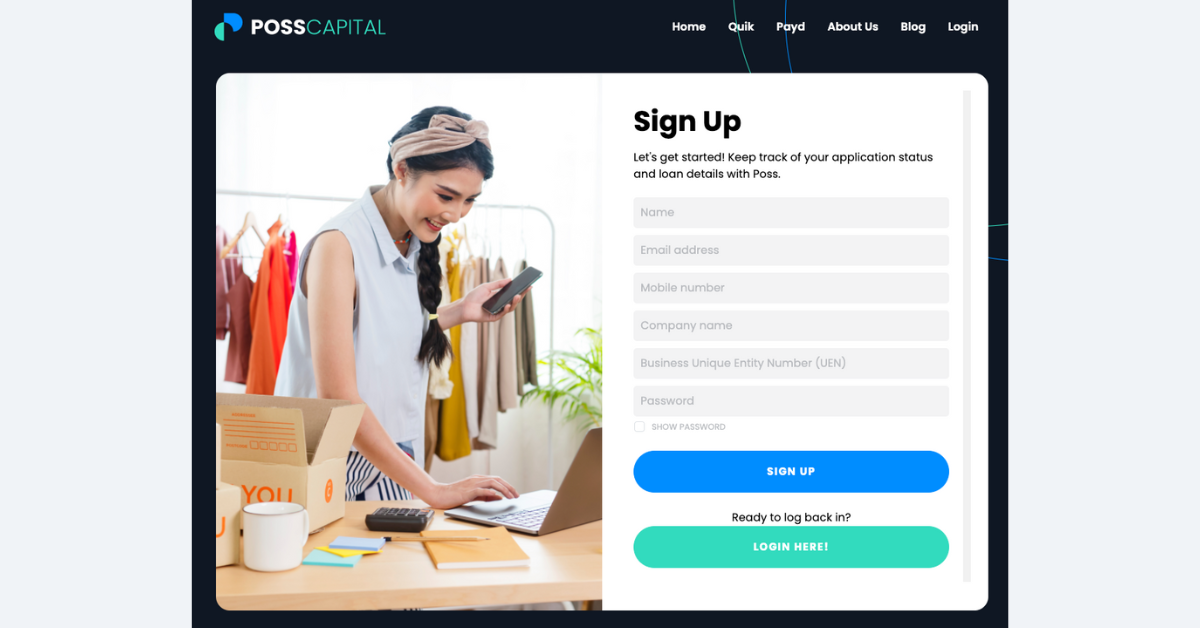

Step One: Create An Account with Poss

Sign up for an account on app.poss.sg.

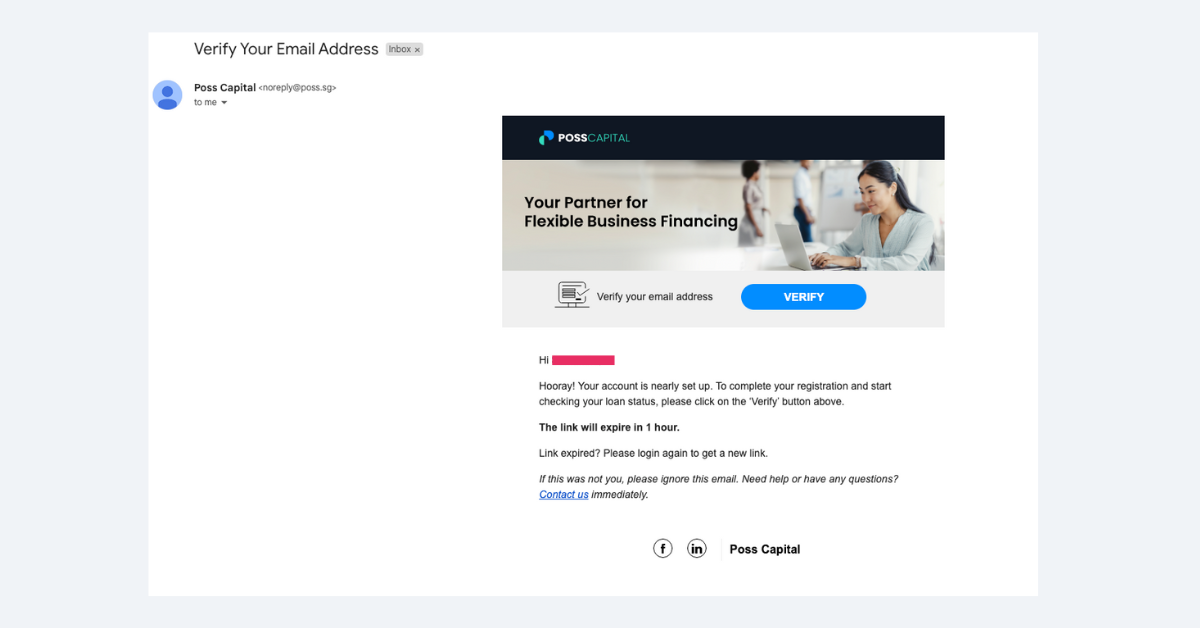

Step Two: Verify Your Email

Check your inbox and verify your email address.

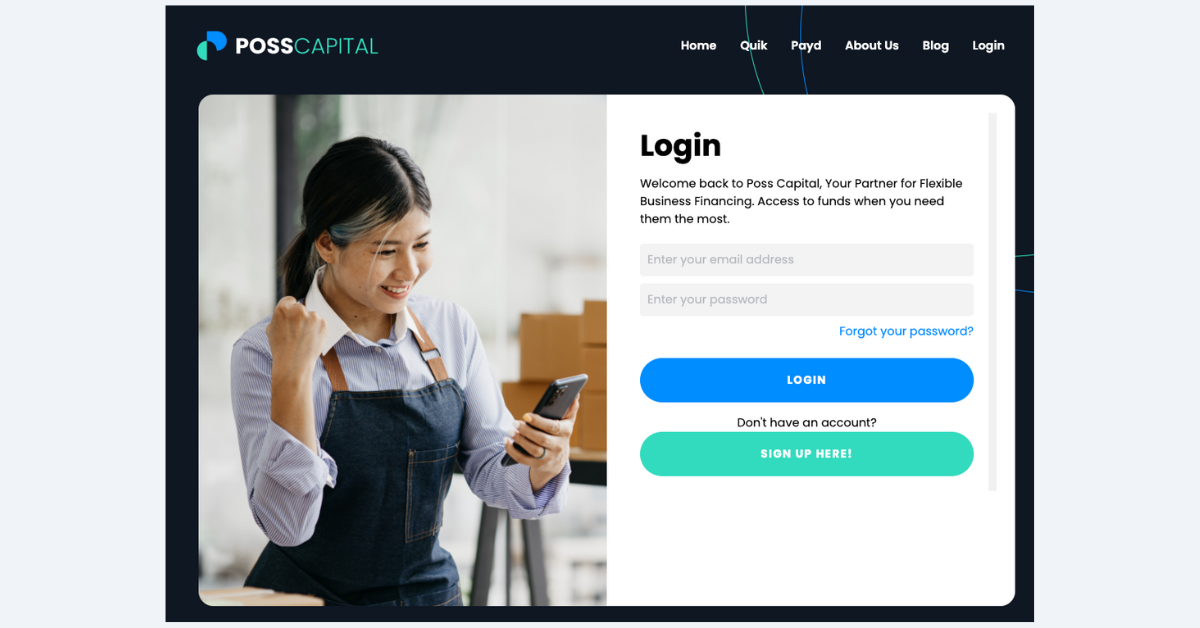

Step Three: Login to App Portal

Login to the app portal with your credentials.

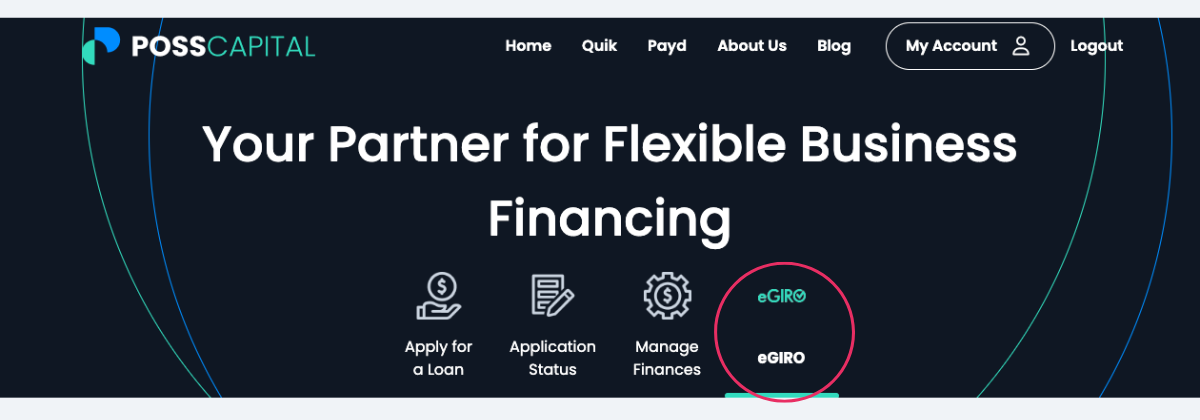

Step Four: Setting Up eGIRO

a. Once you have logged in, click on eGIRO.

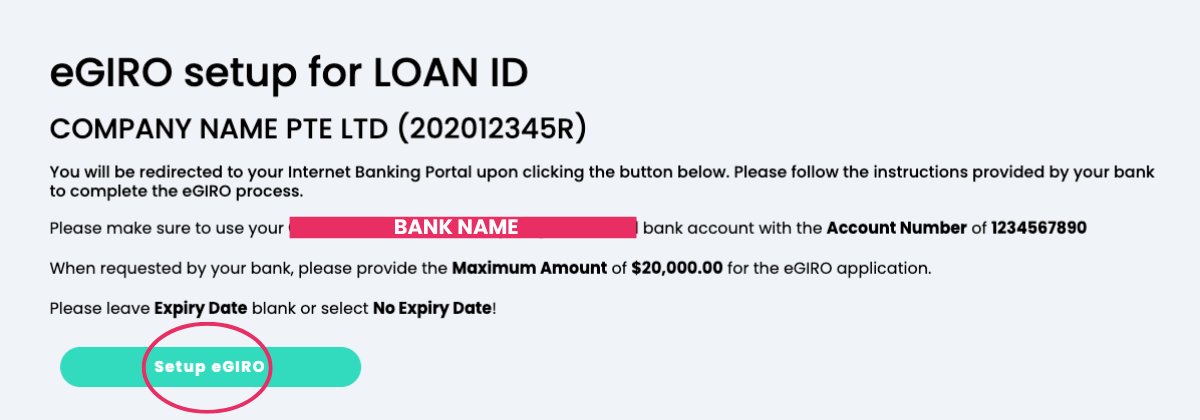

b. Ensure that the details are accurate, and if so, proceed to click Setup eGIRO.

c. A different window will open with your internet banking login. Proceed to login to your bank account and key in the necessary information as shown:

Maximum Amount: $xxxx (as shown in your Poss page)

Expiry Date: No Expiry Date or leave blank

Note: Depending on your business structure, you may have a different business maker and checker for your bank business account. Please ensure that the business checker approves the eGIRO application on the internet banking portal within the stated time.

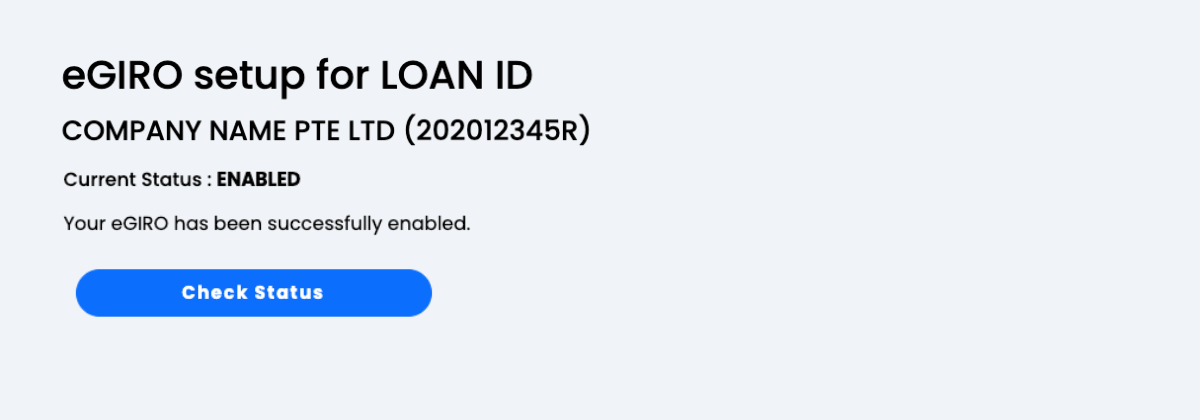

d. Check your eGIRO status.

If your set up is successful, you will see this:

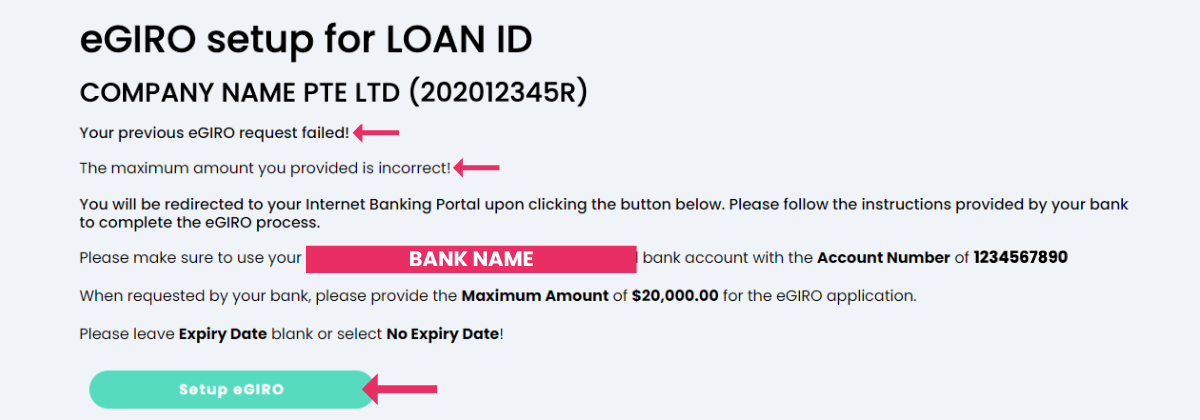

If your set up has failed, you will be able to see the reason:

Proceed to click on “Setup eGIRO” to complete your eGIRO setup again.

Step Five: Receive Your Business Loan

We will disburse the funds into your main operating business bank account within 24 hours of the completion of the loan agreement and after receiving the necessary eGIRO arrangements.

Feel free to contact us if you require any further assistance or visit our blog for more business financing content.